Is Overtime Pay for Exempt Employees Really Becoming Law?

- Author: Lisa Smith

- Categories:

- Tags:

- Share on:

Well, not actual overtime pay for exempt employees. But, it will feel that way when your overtime exempt workers hear this: “You may be getting a pay raise if you make less than $50,440 a year (before taxes)!”

Wait, what?

About 15 million salaried overtime exempt employees who have earned about $455 a week or around $23,660 a year will be greatly affected next year.

For 2016, the FLSA overtime exempt wage threshold is proposed to be bumped up to $970/week which is about $50,440 a year. This is only the second exempt status wage threshold increase in the federal overtime laws since 1975.

Will I still be required to reclassify my overtime exempt employees?

Well, you may definitely have the option to convert an exempt worker to nonexempt status, going from salary to hourly. This may also mean that these folks have to give up some benefits. Bonuses may not be given out as frequently or your policies may change regarding paid vacations. Many employers are expected to convert exempt workers to hourly (non-exempt) in order to save on the $970/week mandate. If this is the choice your company makes, a fair hourly wage will need to be determined and overtime (time and 1/2) paid when the employee exceeds 40 hours in a 7-day work week.

What brought on such changes?

President Obama has observed that middle class Americans nationwide are working long days for less due to the outdated rules on overtime exempt pay requirements. The Dept. of Labor (DOL) agreed. Together, they have proposed a new plan that will increase wages paid to current overtime exempt workers by 1.2 billion dollars in 2016.

What may be some possible cons?

Many entry-level managerial positions may fade away due to these changes. Some employers may insist their employees put in only 40 hours a week and nothing more.

The National Retail Federation (NRF) has already made it known that if this proposal goes into effect, employers will create structures that do not require employees to work overtime. They have calculated that the new proposal will cost them millions of dollars. Instead, they will:

- Lower hourly wages

- Hire more part time employees

- Reduce employees working hours

How will the new federal overtime laws change the way your company operates? This is the question on the minds of employers across the country as we all await the publication of the Final Rule, which could be any day. Now is the time to begin auditing your overtime exempt employee’s job descriptions and next year’s payroll budget.

Choose a Seminar and Save $10

Sexual Harassment & Bullying in the Workplace

1 Day

- CEU: 0.6

- CPE: 6

Team Training - Virtual or In-person

Human Resources for Anyone with Newly Assigned HR Responsibilities

1 Day

- CEU: 0.6

- CPE: 6

- HRCI: 5.5

- PDC: 6

Virtual Seminars:

-

Apr 17

-

Apr 22

-

Apr 23

-

+ 32 more dates

In-Person Events:

- Jul 7, Denver, CO

- Jul 17, Troy, MI

-

+ 2 more dates

Training the Trainer

1 Day

- CEU: 0.6

- CPE: 6

Virtual Seminars:

-

Apr 18

-

Apr 24

-

Apr 29

-

+ 15 more dates

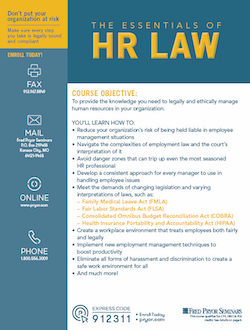

The Essentials of HR Law

1 Day

- CEU: 0.6

- CPE: 6

- HRCI: 5.5

- PDC: 6

Virtual Seminars:

-

Apr 22

-

Apr 24

-

Apr 30

-

+ 24 more dates

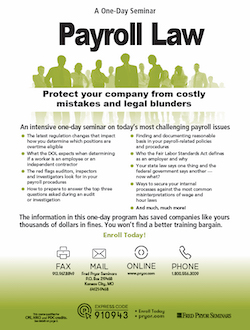

Payroll Law

1 Day

- CEU: 0.6

- CPE: 6

- HRCI: 5.5

- PDC: 6

Virtual Seminars:

-

Apr 17

-

Apr 23

-

Apr 25

-

+ 26 more dates

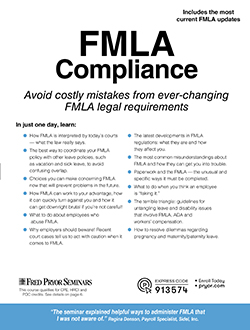

FMLA Compliance

1 Day

- CEU: 0.6

- CPE: 6

- HRCI: 5.5

- PDC: 6

Virtual Seminars:

-

Apr 17

-

Apr 28

-

May 7

-

+ 15 more dates

Comprehensive Training for HR Managers (2-Day)

2 Days

- CEU: 1.2

- CPE: 12

- HRCI: 11

- PDC: 12

Virtual Seminars:

-

Apr 23-24

-

Apr 28-29

-

May 1-2

-

+ 20 more dates

Workers' Comp

1 Day

- CEU: 0.6

- CPE: 6

- HRCI: 5.5

- PDC: 6

Virtual Seminars:

-

Apr 23

-

May 2

-

May 7

-

+ 3 more dates

Learn to Write Effective Policies & Procedures

1 Day

- CEU: 0.6

- CPE: 6

Virtual Seminars:

-

May 5

-

May 16

-

May 22

-

+ 5 more dates